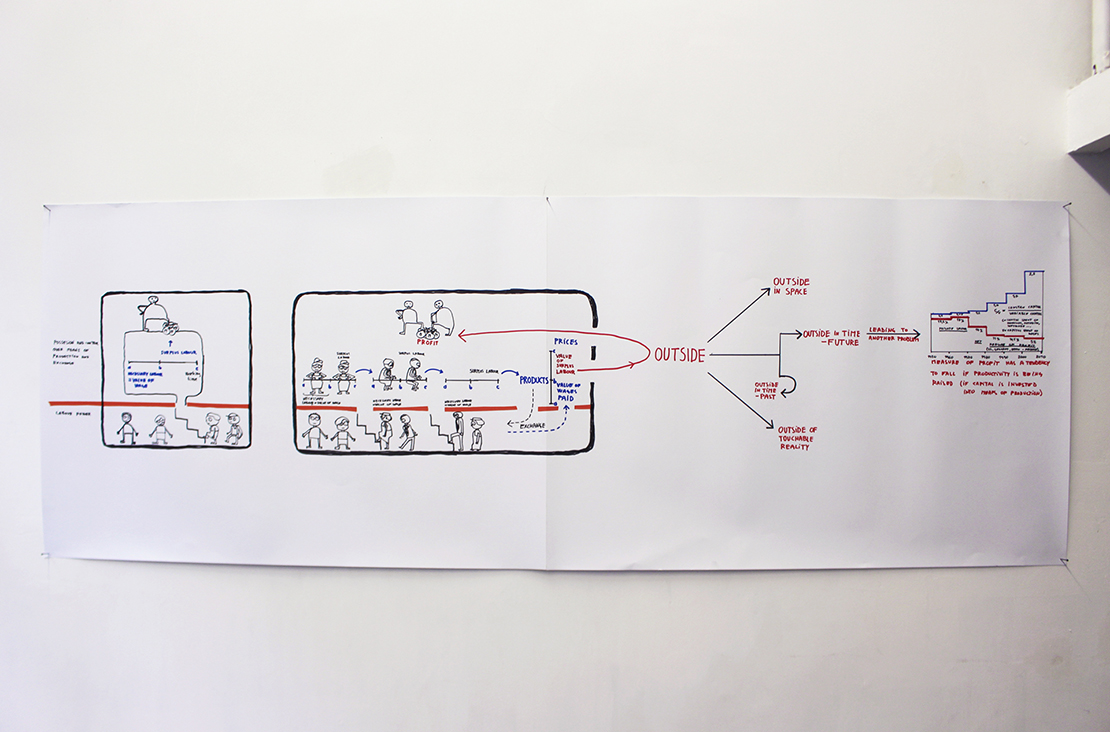

PART 1: The Problem To Whom To Sell The Product Of Surplus Labour?

Human action, work, creativity ... are the source of all value. When labour force is purchased by a for-profit bussineses it is bought with a sole purpose to yield from it surpluse labour. Since surplus labour is the source of profit. Value thus flows from people working, through necessary and surpluse labour being bought, spent and sold, to profit.

But there is a problem: from the perspective of the for-profit economy as a whole, workers can buy no more then the share of value they have been payed in wages, that is the share of neccessary labour. Which is, at best, 2/3 of all the value produced.

To whom to sell the surpluse value? To whom to sell the other 1/3 of value? (Or 2/5, or the ratio of the particular time in history.)

PART 2

Necessary labour is the amount of labour needed to produce the value of wages payed to the workers. Surpluse labour produces value above the necessary value of wages payed and yields profit when sold on the market. The ratio between necessary and surpluse labour dependens on circumstances and oscilates historically (in early 1980s it was around 2 : 1, it has fallen since to around 1,5 : 1).

Since workers receive in wages the necessary share of value produced, that is also their limit to how much they can buy (3/5 or 2/3 or … of all the value produced).

Who, then, can buy the rest, the surplus value? (The 2/5 or 1/3 or ...) To whom to sell the surpluss value?

Could capitalists sell it to each other?

Since capitalists dont buy to consume, but only buy to sell with a profit, buying and selling products, useful things, from each other until these usefull things age and loose value, wouldn’t make profits.

So; in order to make profit the surpluse value must be sold somewhere OUTSIDE. But where?

PART 3

So; in order to make profit the surpluse value must be sold somewhere OUTSIDE. There are several types of such OUTSIDE:

1. type of OUTSIDE is outside in space = outside of the capitalist market. (Example: In the late 18th c. British East India Company colonised Bengalia, at the time the main global exporter of cotton fabrics. Through destruction India swayed from being the main exporter of cotton fabrics to being the biggest market for English cotton industry. But there is a time limit to such primitive exploitation.)

2. type of OUTSIDE is outside of touchable reality, into the realm of mirrored value: Profits can also be taken out of the production and exchange of usable things and put into the realm of trading with mirrored values like assets, bonds, loans, swaps, futures etc. It means trading between the capital owners alone. So value gets connected only to their collective faith, skiping the world of useful things, of workers, of consumers, of majority of people altogether. Being so much less restrained, financial trading has become around 6 times bigger then the real economy. However, what if a large part of that financial value-bubble seeks refuge back into the much smaller world of usefull, everyday things? Then the crash comes. Like the burst of .com bubble at the end of the 1990ties or the financial collapse of 2007 and 2008.

3. type of OUTSIDE is outside in time - in the past: Parasiting on the wealth and capacities accumulated in the past can also be source of profits. (Example: Our current era of privatisation and draining of public goods, lowering of wages and intesification through raising unemployment and precarisation of employment, pushing up the real-estate prices etc.) But the shortcoming of such an aproach is evident; it can only work for a very limited time. After a while accumulated problems escalate, as we are experiencing today.

4. type of OUTSIDE is outside in time - in the future: Profits are being invested into the expansion of capacities for production (new factories, new products, new industries etc), which are expected to be utilised -and profitably realised- only in the future. (Example: The post WW2 era of fast growth of industry, public services and social protection, of living standard of workers etc.) The inherent limit of such an aproach is that it only works in the exceptional historic conditions which allow for at least around 5% overall profit-driven economic growth. For the golden era of post WW2 period such conditions ended in the 1970ties.

Each of the approaches is plagued by the problem of un-sustainability.